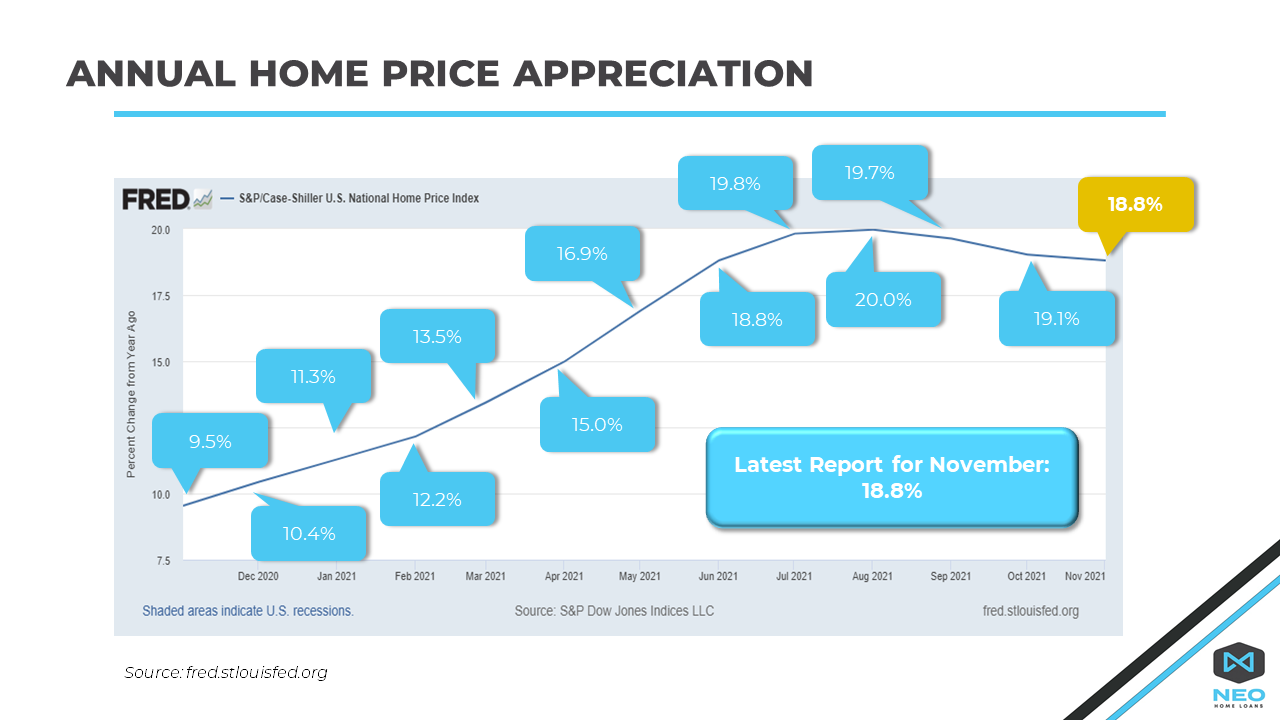

Even before the pandemic pushed the U.S. housing market into overdrive, the price of the average American home was on a rocket ride, climbing more than 50% between 2012 and 2019. It was the third biggest housing boom in American history.

Then came the pandemic, marked by a buying frenzy and a selling freeze, which created a supply-demand mismatch that made the price boom go into warp speed.

In real terms, the average price of housing in the United States is now the highest it’s ever been — even higher than the peak of the housing bubble in 2006.

Now that home prices have surpassed the peak that preceded the 2000s housing crash, speculation about the stability of the housing market and worries of another crash are only becoming more intense.

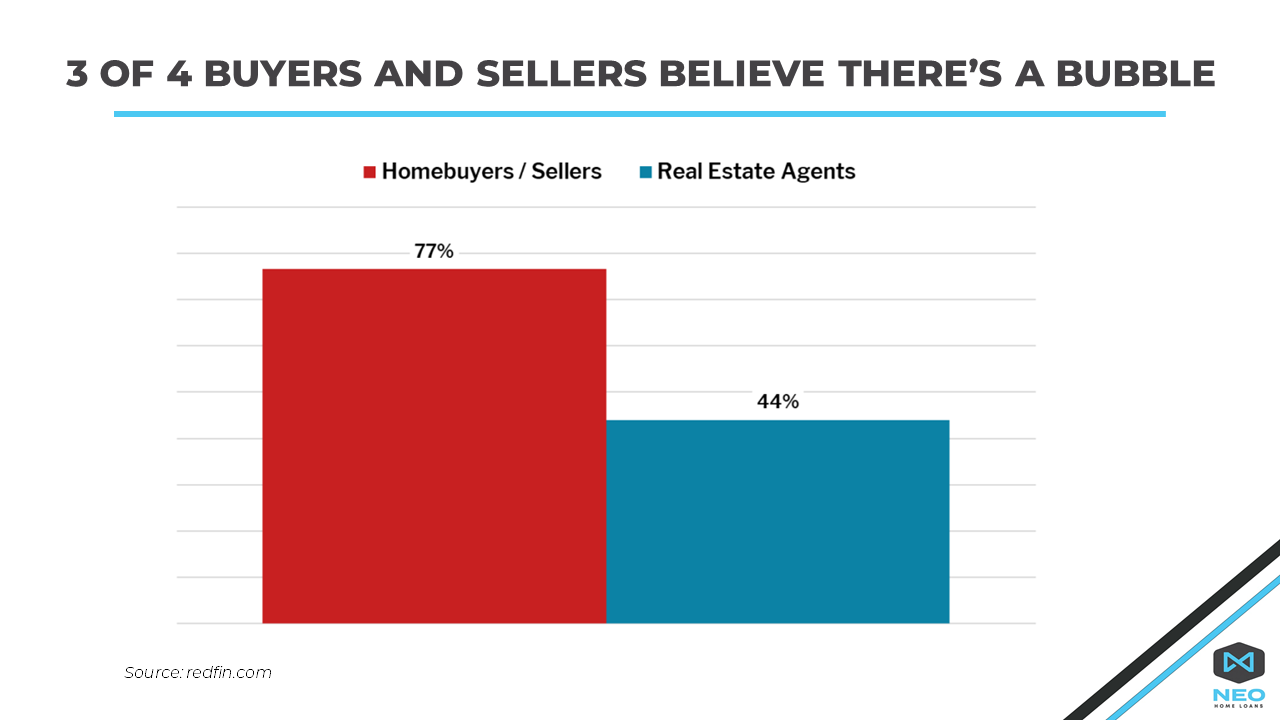

Homebuyers Think We Are In A Housing Bubble

A housing bubble is characterized by rapid unsustainable growth in home prices, eventually “bursting” when demand no longer supports the high home values, followed by sharp price declines. It’s typically caused by an influx of demand from homebuyers and real estate investors.

According to a recent survey by Redfin, more than three-quarters (77%) of homebuyers and sellers believe there’s a housing price bubble in the area where they live, while 44% of real estate agents believe there’s a housing bubble in the market where they work.

What Our Top Mortgage Advisors Are Saying

We asked our top mortgage advisors, who constantly study market trends, about their reaction to the above data and if they believe rapidly rising home prices mean we are in a housing bubble. Here’s what they said.

“This is the exact opposite scenario that is giving everyone PTSD from 2007. We are a long ways from a bubble currently.”

– Mike Jones, NMLS# 33323

“This drastic divide shows that relying on friends/family/media to make conclusions on your home purchase is not a wise idea. The 44% of realtors who responded that we’re in a bubble likely don’t understand the economics of supply/demand behind the rapid price appreciation we’ve seen. Before you decide it’s a bad time to buy, look at the data with a trusted advisor.”

– Jason Drobeck, NMLS# 826629

“No sir. The data speaks for itself. We are right where we should be if you take 2008-2018 out of the charts ranging from 1958 to 2021.”

– Jen Jacques, NMLS# 531247

“Anyone who remembers and lived through the last housing crash likely has fear of a repeat. In no way are we in the same environment as we were then. Trust the data, ask the right questions from the RIGHT people who know more of what is going on rather than relying on friends, family, or a crisis news network (media) to understand really what is going on. Trusted advisors are key to understand how/when to make a move in real estate investing.”

– Katrinka Condie, NMLS# 1542179

“There is still a very high demand and little supply with houses, so a housing bubble won’t be happening. Also, builders are WAY behind thanks to the supply chain challenges and labor shortages. Growing population and first-time homebuyers entering the market will also ensure the bubble doesn’t happen.”

– David Nelson, NMLS# 223291

“The real estate market is one of the healthiest sectors in the economy. The big majority of homeowners have no mortgage or a low mortgage-to-value ratio making them very protected from any price drops. Meaning that the factors for a huge price drop like 2006 are not there. Also recessions don’t equal housing bubble. In the last 6 recessions, 5 out of the last 6 prices increased or stayed the same during the recession.”

– Sosi Avila, NMLS# 1511489

The Bottom Line

The pandemic-driven housing boom is fundamentally different from that of the mid-2000s, when loose lending criteria allowed many homebuyers to take out mortgages they couldn’t afford. That resulted in millions of foreclosures and a sharp decline in home prices.

We are confident that while the growth of the market will slow down, we are not in a housing bubble and nowhere near a crash. Home prices may be pushing the bounds of affordability, but this current housing boom should not end in a bust thanks to strict mortgage lending standards and strong demand.

Have questions about the future of the housing market or want to know if the time is right for you to invest in real estate? Fill out the form below to request a mortgage discovery consultation with one of our mortgage advisors.