On February 22, the Department of Housing and Urban Development (HUD) announced a 30 basis point reduction (.3% of the loan balance) to the annual mortgage insurance premiums (MIP) charged to homeowners with a mortgage insured by the Federal Housing Administration (FHA).

Beginning March 20, the premium will be reduced from 0.85 percent to 0.55 percent, which could mean an estimated savings of $678 million for American families in aggregate by the end of 2023 alone.

What Is The FHA MIP?

The FHA’s mortgage insurance premium is how HUD funds the FHA mortgage program. When getting an FHA mortgage, borrowers pay both an upfront and annual mortgage insurance fee.

The FHA provides insurance to lenders in the event that a borrower stops paying their mortgage. Because lenders have some financial protection from borrower default, they’re able to offer mortgages to borrowers with lower credit scores or smaller down payments.

What Is Changing?

The annual MIP is paid as a percentage of the borrower’s loan amount, and how much an individual pays depends on how much they borrowed, their down payment, and the loan term. Currently, most borrowers pay an annual MIP rate of 0.85%.

When the reduced MIP rates go into effect on March 20, borrowers of new FHA mortgages will have access to the new annual MIP rates. The typical borrower will now pay 0.55% of their loan amount annually in mortgage insurance costs.

With this lower rate, homebuyers with new FHA mortgages will be able to save an average of $800 per year, according to the White House fact sheet.

Who Will Be Affected?

This action is another step toward making homeownership more accessible and affordable for the nation’s working families.

The annual MIP reduction will apply to almost all single-family home mortgages insured by the FHA after March 20. The reduction will apply to all eligible property types, including single family homes, condominiums, and manufactured homes, all eligible loan-to-value ratios, and all eligible base loan amounts.

According to the Mortgage Bankers Association:

The lower premiums will expand homeownership opportunities by lowering mortgage payments for qualified FHA borrowers, providing critical relief from the steep rise in mortgage rates and home prices just in time for the spring buying season. This will especially help minority homebuyers and low-and moderate-income households who are predominantly served by FHA loans.

With a 3.5% down payment on a median-priced home, a borrower would need a loan of $451,330. With an annual MIP of 0.55%, they’d pay $2,482 each year on FHA mortgage insurance, or around $207 every month. With the old MIP of 0.85%, that same borrower would have paid $3,836 annually, or $320 per month. This means that the new MIP rates could reduce a borrower’s monthly mortgage payment by $113.

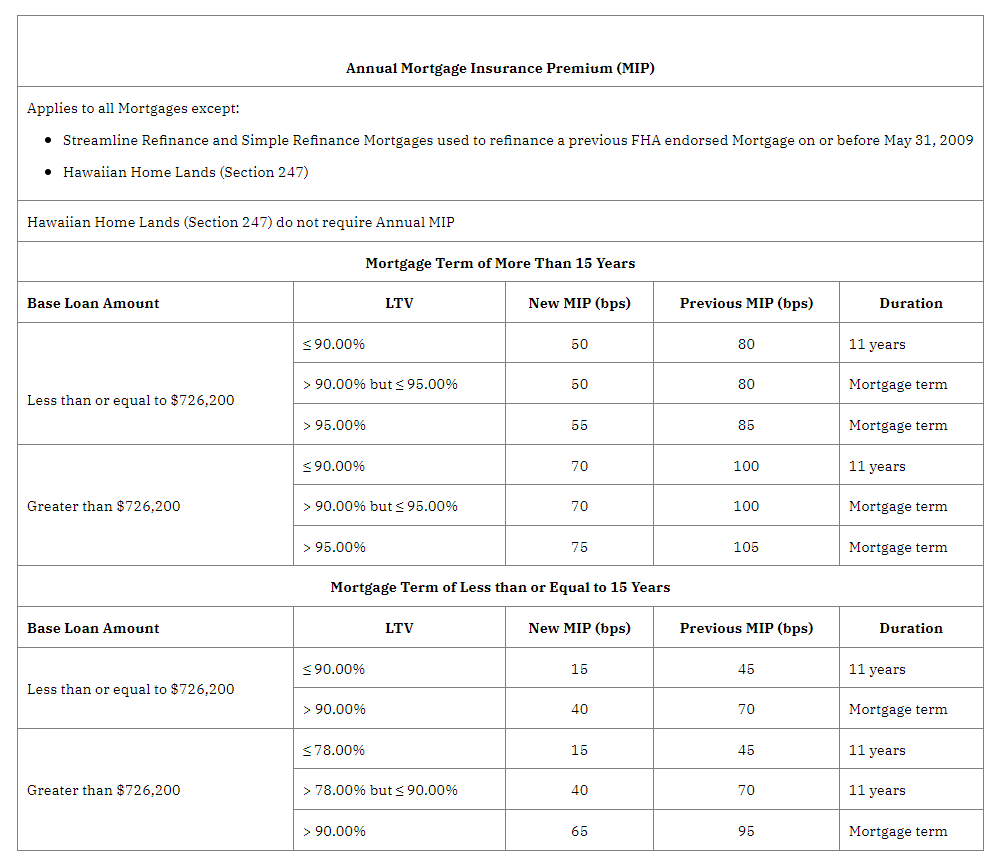

The annual mortgage insurance premium reductions are noted in the table below provided by HUD.

What Does This Mean For You?

If you are planning on buying a home this year, this MIP reduction will save you hundreds of dollars each year on your mortgage. It could also help you qualify for an FHA loan if you did not meet qualification standards in the past due to a high debt-to-income ratio.

If you would like to see just how much you will save on an FHA mortgage with these new guidelines, fill out the form below to request an FHA loan estimate from a mortgage advisor.