Despite what you might be seeing in the news, big money investors have not given up on the residential real estate market.

What does Wall Street know that Main Street does not?

According to Yardi Matrix’s report, Build-to-Rent Fuels Growth in Institutional Single-Family Rental Market, institutions funded $2.5 billion in single-family rental acquisitions in 2021 and committed more than $60 billion in capital to buying single-family rental homes in 2022.

Yardi anticipates that by 2030, institutions will own about 7.6 million homes, accounting for almost half (40 percent) of all single-family-rental units in the country.

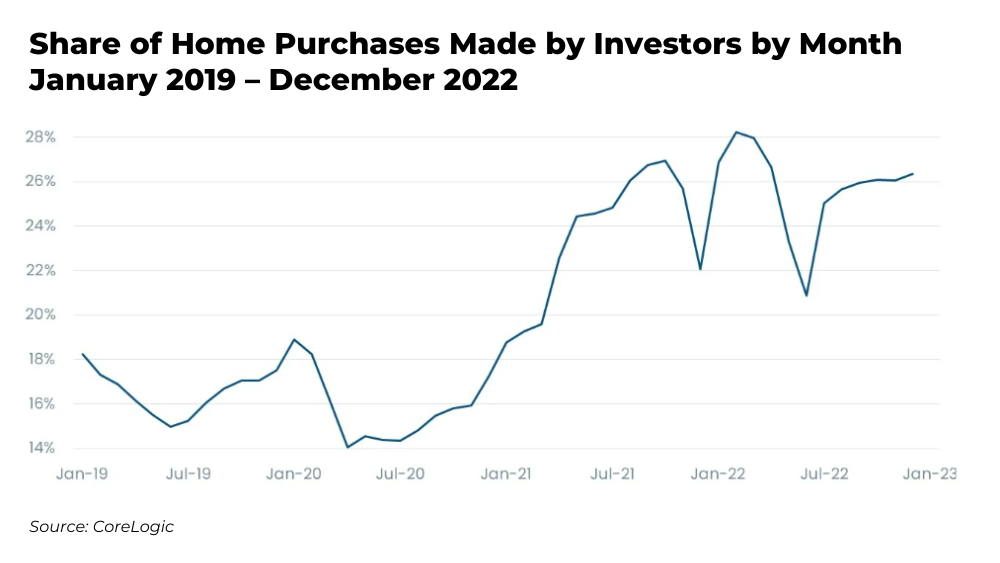

And we’re already starting to see the takeover happen. According to CoreLogic, investors purchased 26% of single family homes in Q4 of 2022. Even with high acquisition costs fueled by interest rates, this is only a 2% drop from the high of 28% in February 2022, and is much higher than at any point pre-pandemic.

Stories of institutions and big pocketed investors betting on the residential housing market are starting to become more common:

- We recently wrote about how Don Mullen, former Goldman Sachs Executive and Founder of Pretium Partners, bought up a slew of distressed properties post-2008 and is still going all in on residential real estate.

- In November, Haven Realty Capital and JPMorgan Chase’s asset management arm announced they will invest up to $1 billion to develop build-to-rent single-family homes across the country.

- Last month, Warren Buffet bet on a strong housing recovery. Berkshire Hathaway’s SEC filing showed a purchase of 7 million shares, worth $417.1 million, in Louisiana-Pacific, a homebuilding solutions company.

- In 2021, Jeff Bezos invested in the real estate startup Arrived Homes during its seed round, then doubled down on that investment in the company’s series A round last year. Arrived Homes acquires single-family rentals across the U.S., securitizes them, then allows retail investors to buy shares of individual properties.

- Elon Musk is also starting his own play to get a piece of the residential real estate market by partnering with Lennar Corp., one of the nation’s largest home builders, on building “Project Awesome” – a new residential area of 110 homes in Texas that could provide housing for employees of Musk’s companies.

What Does This Mean for You?

Big investors are undeterred by the volatile real estate market. They know that the high demand for homes and low supply means residential real estate is a safe investment. If banks, hedge funds, and big money are purchasing homes in an environment when acquisition costs are so high, what will happen when interest rates come down?

There are a lot of people fearful about the housing market, and smart investors are taking advantage of this – and you should be too!

There is a window of opportunity right now. Consumer confidence is low (although it is rising) and many prospective homebuyers and investors are sitting on the sidelines or trying hard to sell their properties. This means there are more homes available to purchase at a discounted price, and even room for more negotiation for seller credits to assist with down payment, closing costs, or an interest rate buydown.

This opportunity in housing will not be around forever. Don’t let it pass you by!