There are a few really important numbers when it’s time to obtain a home loan: your credit score, the amount you want to borrow, and the interest rate. The news is full of talk about interest rates lately. Will they go up? Will they go down? Will they stay down?

It’s a losing battle to follow the news on mortgage interest rates on a daily basis if you’re hoping to lock in the best possible loan rate. However, you can certainly get a sense of key trends by keeping your eyes and ears open when it comes to the economy and the bigger picture of the housing market.

However, before you do that, you’ll want to make sure you understand what factors are at play that will be influencing mortgage rates in 2024.

Economic Health & Supply and Demand

The overall economy affects mortgage rates. When the gross domestic product (or GDP) and employment rise, it’s a sign of a growing economy, so there is a greater demand for goods and services, including real estate. A growing economy creates competition from those wishing to borrow money. This demand causes interest rates to rise.

The opposite is true in a slowing economy. When demand falls, interest rates tend to go down.

In terms of home loans, the “supply” is the money (or credit) available to lend. A high demand for mortgages means banks have less money to lend; therefore, the cost of a loan goes up via higher interest rates.

This also means that when there is more money to lend, or an increase in the supply of credit, the cost of borrowing goes down in the form of reduced interest rates.

Another factor is how other debts impact a bank’s ability to lend money. For example, a missed credit card payment or mortgage payment will reduce the amount of credit available in the market. When the credit supply tightens, that creates higher interest rates.

Inflation

Everyone is affected by inflation. You, your mom, your dry cleaner, and even your bank.

Inflation occurs when the money supply used to purchase products exceeds the products available for purchase. The bigger the gap, the higher the inflation. Put another way, a high rate of inflation means your dollar doesn’t go as far. You have to do more with less.

Higher inflation will typically cause Treasury yields and mortgage rates to rise as well. This occurs because investors demand higher rates as compensation for the decrease in the purchasing power of money they are paid over the course of the loan.

The Federal Reserve

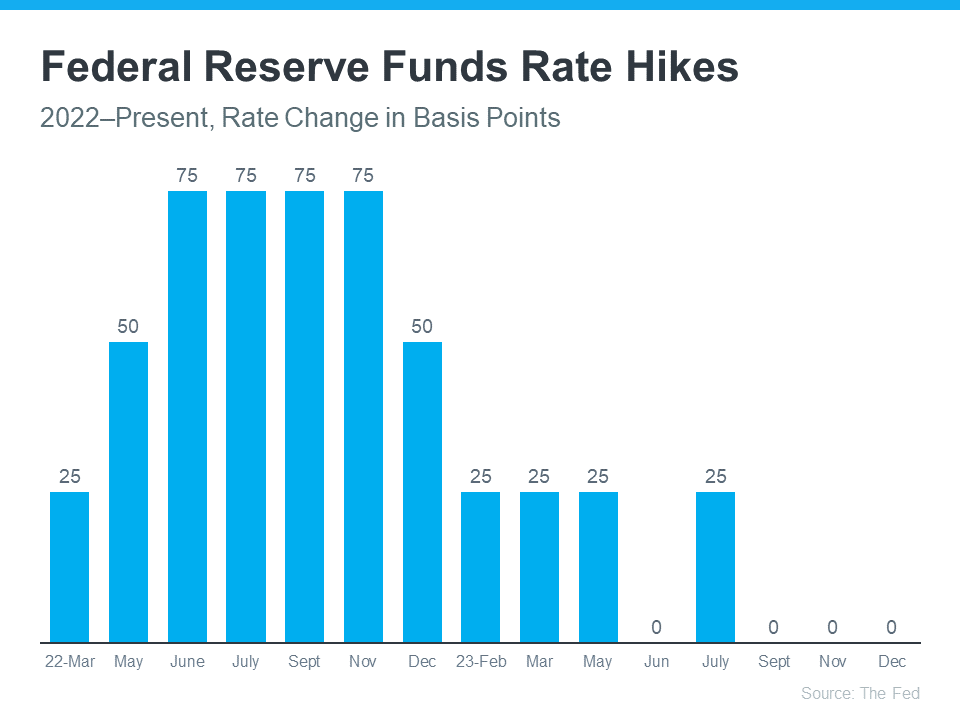

When the Federal Reserve raises or lowers the federal funds rate, which is the rate lenders charge one another, it can create a ripple effect resulting in higher or lower mortgage rates. While the Fed Rate doesn’t have a direct impact on mortgage rates, it impacts several markets across the globe, and the effects are felt in the mortgage market.

The fed funds rate can be as low as zero, and it affects the bottom line of those offering credit. When the Fed is trying to control inflation, or cool the market, they start raising this rate in increments over time. When they’re trying to spur the economy, they start lowering the fed funds rate.

Recently inflation has started to cool, a signal that the rate increases over the past few years have worked and are bringing inflation back down. As a result, the Fed’s hikes have gotten smaller and less frequent. In fact, there haven’t been any increases since July.

And not only has the Fed decided not to raise the Federal Funds Rate the last three times the committee met, they’ve signaled there may actually be rate cuts coming in 2024.

Your Credit Score

No surprise here. Mortgage lenders want to feel confident that you’ll pay back your loan. They’re willing to trade a lower interest rate for this peace of mind.

Though every lender and loan program is different, borrowers with a credit score above 720 typically qualify for the best interest rate offers.

Having a strong credit history, one that includes a lengthy track-record of consistently paying bills in a timely manner and maintaining low balances on lines of credit, drives your credit score upward. This is generally the type of profile prospective lenders like to see.

But don’t worry if your credit isn’t perfect.

Before applying for a mortgage, it’s a good idea to check your credit score and do what you can to improve it if there are any areas of concern. If you still have some time before you need to apply for a mortgage, actively work on boosting your score. A NEO mortgage advisor is always available to discuss your unique credit journey and homeownership goals with you.

Your Loan-to-Value Ratio

Yet another consideration for lenders when developing interest rate offers is your loan-to-value ratio (LTV). This is essentially a comparison between the amount of the loan you’re seeking and the value of the property you hope to purchase.

Borrowers who have a more substantial down payment for their home purchase—which lowers the amount to be borrowed —have a lower LTV. This is a good thing from the lender’s perspective because borrowers who have a more sizable down payment tend to be a lower risk.

The Bottom Line

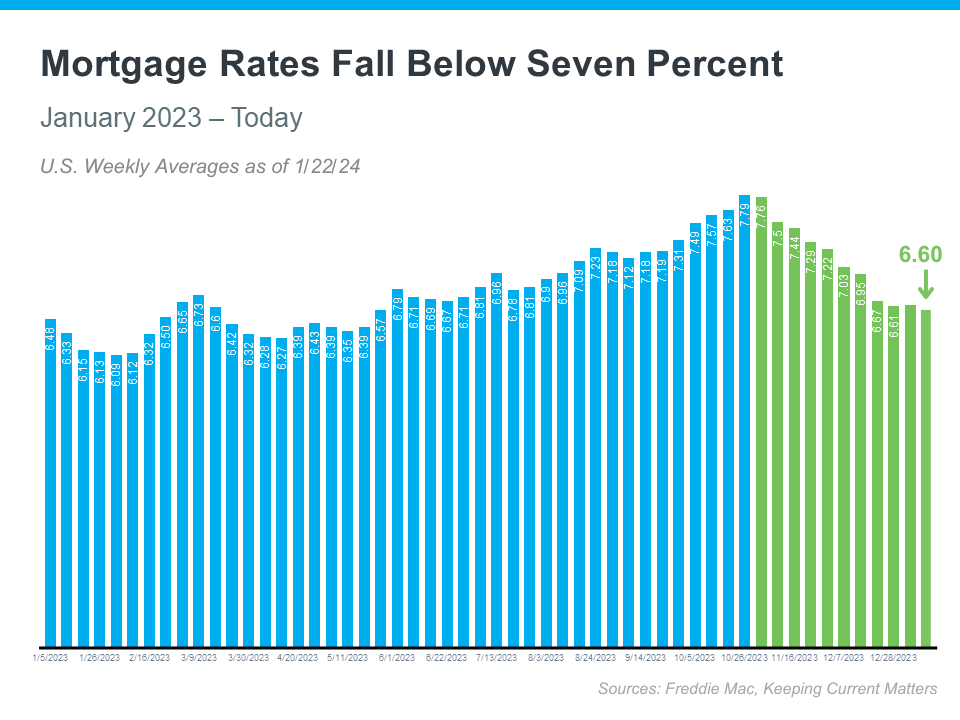

Mortgage rates have come down in recent months. We are still optimistic that 2024 will continue to bring lower mortgage rates and provide some relief for homebuyers.

This won’t be an immediate drop to 5% mortgage rates. We will likely see some ups and downs in the months ahead, but the recent economic reports are clear indicators that the trend has reversed from higher and higher mortgage rates to lower rates ahead.

If you are not ready to make a move just yet, here are 3 steps you can take now to prepare for when the time is right:

1. Schedule a meeting with a mortgage advisor (even if you are not ready to buy!)

It’s always best to do this sooner rather than later. No credit check or application needed – we will just discuss your options and put a plan in place so you can move quickly when the time is right.

2. Choose a loan program.

Every mortgage program has unique benefits and different requirements to qualify. If you learn about these now and choose the one that makes sense for you, you will have a solid roadmap for what you need to do to prepare for your purchase.

3. Start improving your finances.

Once we’ve decided on the best mortgage strategy, the rest of the time will be spent here. Get your down payment in order, make sure you have all your income and asset documentation, pay off any debt you need to improve your credit score, and start planning for your new housing payment.

Preparation is key in this market! Starting the process early will make sure you are able to submit an offer on a home right away and lock in a lower rate when the time is right.

If you would like to know exactly what you need to do to prepare for a home purchase, fill out the form below to schedule a consultation with one of our mortgage advisors. They will answer all your questions and create a detailed loan comparison and action plan so you can be ready to submit an offer and move quickly when the time is right.