This article was originally posted on moneygeek.com with collaboration from Ryan Grant, Division President at NEO Home Loans.

Buying a home often involves securing a mortgage, a long-term loan designed for real estate. But life changes, and so do financial needs. Enter mortgage refinancing — the process of replacing your current mortgage with a new loan featuring different terms. Homeowners commonly refinance to take advantage of lower interest rates or reduce monthly payments. Refinancing can be a strategic financial move, but you need to know its ins and outs to determine if it’s right for you and make an informed decision about mortgage refinancing.

How a Mortgage Refinance Works

When you refinance a mortgage, you’re swapping your current home loan for a new one. Let’s say your original mortgage has a high interest rate. If you refinance when rates are low, a new loan with a lower interest rate would replace it. The amount you owe on your home, the principal, usually stays the same, but the interest rate — and often the loan term — can change.

Imagine you owe $200,000 on your mortgage at a 6% interest rate. If you refinance to a 4% rate, you could save thousands over the life of the loan. Refinancing is a smart way to revisit your mortgage terms and make them work better for you.

Homeowners often refinance to reduce monthly payments, switch from an adjustable to a fixed-rate loan or cash out some of their home equity for goals like home improvement or debt consolidation. Knowing how refinancing works helps you decide if it’s the right move for your financial health.

Understanding Refinance Rates

Mortgage refinance rates refer to the interest rates you can get on your new loan when you refinance. They may be similar to your original mortgage rates or quite different, depending on market conditions and your financial profile. Like with your first mortgage, a lower refinance rate usually means lower monthly payments and less money spent over time.

Several factors influence refinance rates, including your credit score, the loan-to-value ratio of your home and the general state of the economy. If you want better rates, aim for a stellar credit standing, consider a shorter loan term and shop around to compare offers from different lenders. By paying attention to mortgage refinance rates, you’ll be more equipped to lock in a deal that benefits you in the long run.

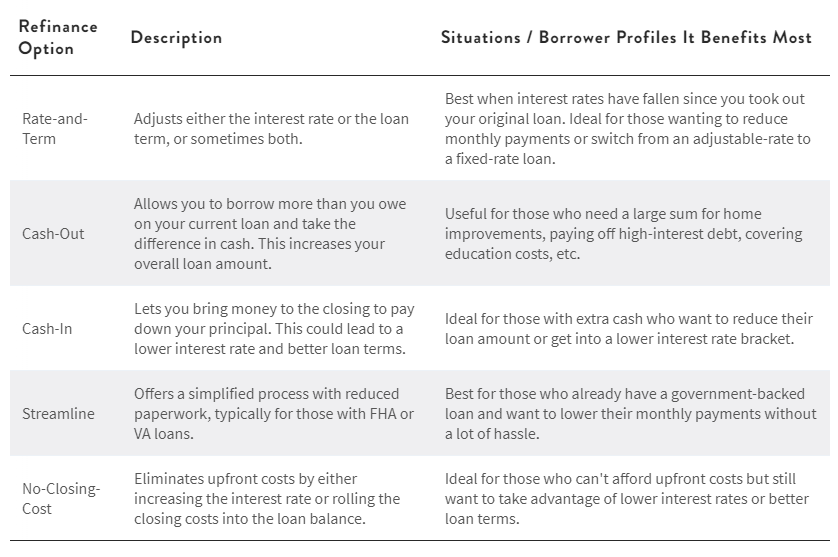

Types of Mortgage Refinancing

You have several options for refinancing, the same way you had choices when you selected your original mortgage. Whether it’s a rate-and-term or cash-out refinance, knowing the different types can help you pick the one that best suits your needs as it directly affects how much money you save or gain in the process.

As you’re figuring out how to refinance a mortgage, keep these options in mind. Matching the right type of refinance with your financial goals can make a world of difference in your long-term financial health.

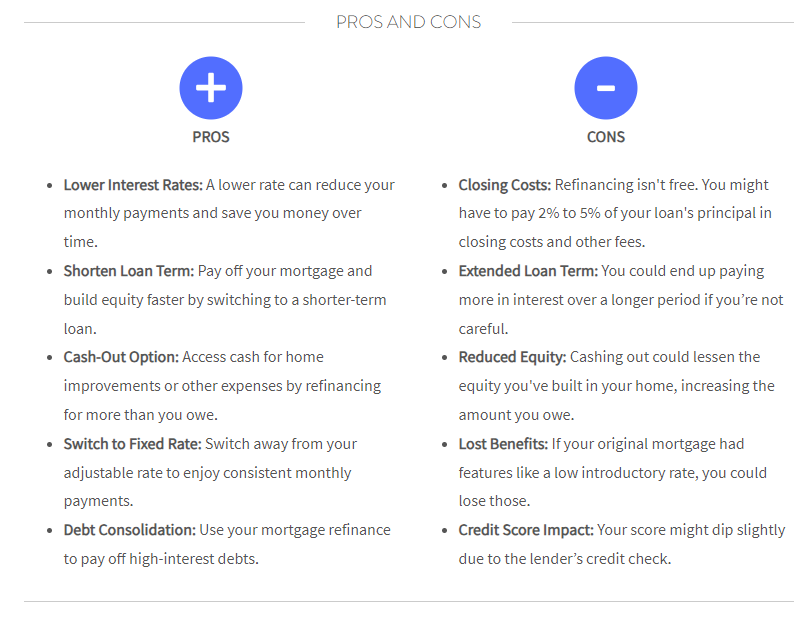

Pros and Cons of Refinancing Your Mortgage

Refinancing your mortgage is a significant financial move — it’s like hitting the reset button on your home loan. While it can offer perks like lower interest rates and cash access, it also has its fair share of risks, such as fees and potentially longer loan terms. A hasty decision could land you a great deal or put you in a financial rut.

Consider both the pros and cons of refinancing your mortgage. Zeroing in on only one aspect could leave you with surprises down the road, like saving money today but paying more over time.

Consider your long-term financial goals, your current situation and how each pro and con applies to you. If the potential benefits align with your goals and outweigh the risks, then refinancing could be a great step forward.

When to Refinance

Deciding to refinance your mortgage is a big step, and timing is essential. Market conditions should be favorable, and your financial situation should be stable. Once you’re confident about the timing, the next factor to consider is why you want to refinance. Let’s first explore the ideal circumstances that could make refinancing a smart financial move.

- Right Market Conditions. When mortgage refinance rates are lower than your current rate, it presents an opportunity for savings. Even a difference of at least 1% can translate to thousands saved over the loan’s lifespan.

- Stable Income. Before making the leap to refinance, ensure you have a reliable income. Job stability and a solid income stream will make it easier for you to handle new, perhaps different, mortgage payments.

- Improved Credit Score. If your credit score has improved since taking out your original mortgage, you’re more likely to qualify for better loan terms. Higher scores may secure you lower interest rates and a better loan-to-value ratio.

- Home Equity. The value you’ve built up in your home affects both the refinance rates you can secure and the loan options available to you. High equity usually translates to more favorable terms.

- Length of Stay. If you’re selling the house in the near future, you might not recoup the upfront costs in time, making refinancing less advantageous. However, if you plan to live in your home long term, a refinance may be a solid option.

How to Refinance Your Mortgage

Knowing the refinancing process can help you hit the ground running when the time is right. You’re more likely to spot a good deal, negotiate with lenders and make choices that align with your financial goals. Here’s how to refinance a mortgage:

1. Determine Your Goals

Ask yourself why you’re considering a refinance. Is it to lower your monthly payments, change your loan term or maybe get some extra cash? Having a clear objective helps you select the right loan.

2. Check Your Credit Score

Your creditworthiness affects the interest rate you’ll get. Know your credit score ahead of time and correct any errors you find.

3. Research Lenders

Don’t settle for the first lender you come across. Shop around, compare rates and read customer reviews. Look for lenders who specialize in the type of refinance you’re considering.

4. Review Home Equity

Knowing how much equity you have in your home affects your refinance options. Generally, you’ll need at least 20% equity for the most favorable terms.

5. Get Your Home Appraised

An appraisal tells you the current market value of your home. Lenders require this to determine the new loan amount.

6. Submit Official Application

After selecting a lender, you’ll fill out an application and provide necessary documentation like tax returns and pay stubs.

7. Review Terms

Once approved, you’ll get a loan estimate. Study it carefully to ensure it meets your financial goals, and don’t hesitate to ask questions.

8. Close the Loan

Attend the closing meeting to sign the final paperwork and possibly pay closing costs. Make sure all the terms are what you agreed upon before signing.

Refinancing a mortgage can be a solid financial move if done thoughtfully. As you engage with lenders, keep your financial objectives in focus and don’t hesitate to ask questions. Evaluating the terms and knowing how to refinance a mortgage can lead you to a deal that’s tailored to your needs.

Costs Associated With Refinancing

Refinancing your mortgage can offer several advantages, from lower interest rates to more manageable monthly payments, but it’s not free. Being aware of potential costs can help you make a well-informed decision, and you can even use this information to negotiate better terms with your lender.

Here are some costs to consider:

- Application Fee: This fee covers the lender’s cost to process your application. It’s usually non-refundable; however, some lenders might consider waiving it. Make sure you’re confident about your decision to refinance before proceeding.

- Origination Fee: This fee, which can often be negotiated and varies between lenders, is what the lender charges for creating the loan. It’s typically a percentage of the total loan amount. It’s always wise to shop around to find the best terms.

- Appraisal Fee: Lenders require an appraisal to determine your home’s current value.

Understanding the cost of refinancing a mortgage is essential for assessing whether it’s the right move for you, especially if your goal is to save money in the long run.

Minimizing Costs

When it comes to minimizing costs, there are several strategies you can implement. One approach is to negotiate fees with the lender. For instance, some lenders might be willing to waive the application or origination fee to secure your business. A straightforward conversation can sometimes result in substantial savings.

If you’re looking to minimize upfront costs, you might consider a no-closing-cost refinance. This loan type has no upfront fees, but the lender makes up for it by rolling the closing costs into the loan or offering a slightly higher interest rate, meaning you’ll pay more over the life of the loan.

Frequently Asked Questions About Mortgage Refinance

Let’s dive into some frequently asked questions that many borrowers have about mortgage refinancing. Our answers can provide valuable insights into the refinancing process.

What is a mortgage refinance?

Mortgage refinance is the process of replacing your existing mortgage with a new one, usually with different terms, such as a lower interest rate or a shorter loan term. It can help you save money, build equity faster or tap into your home’s value.

Is a second mortgage the same as a refinance?

No, they’re not the same. A second mortgage is an additional loan taken out on your property while keeping the original mortgage intact. A refinance replaces your original mortgage with a new one, generally with better terms.

Will refinancing affect my credit score?

Yes, refinancing can affect your credit score. Applying for a new loan involves a hard inquiry on your credit report, which may temporarily lower your score. However, applying within a short timeframe can mitigate the impact. Moreover, responsible management of your new mortgage can lead to score improvements in the long run.

What are the costs to refinance a mortgage?

Some common closing costs include the application and origination fees. These can range from 2% to 5% of the loan amount. Make sure to factor these into your calculations to ensure refinancing makes financial sense for you.

What’s the difference between rate-and-term and cash-out refinance?

Rate-and-term refinance changes the interest rate, the loan term or both. Cash-out refinance allows you to take out a new mortgage that’s larger than your existing one, and you get the difference in cash.

Can I refinance my mortgage with bad credit

It’s possible but challenging. You’ll likely face higher interest rates and less favorable terms. Some government programs may help you refinance with bad credit, but it’s key to improve your credit score for better options.

Do I need an appraisal to refinance my mortgage?

Most lenders require an appraisal to determine your home’s current value. However, some types of refinances, like streamline refinances, may not require an appraisal.

Expert Insight on Mortgage Refinancing

What questions do homeowners need to consider before refinancing?

The question of refinancing is actually much more complex than most people think. As a homeowner, you want to consider your entire real estate and financial plan before considering a mortgage refinance. Unfortunately, mortgage companies are focused on selling loans, so almost any loan officer will try to convince you that refinancing makes sense. The major questions you want to consider are the following:

- Can I save money on my mortgage each month, and if so, how much will it cost me to do so? Then, what is the breakeven timeframe, and how much longer do I intend to keep this home?

- Can or should I try to shorten the term of the mortgage and pay the mortgage off faster? The answer to this should be “no” to almost everyone, but this can make sense in rare circumstances, depending on a few factors.

- What is my “Household Blended Debt Ratio,” or HBDR? This is where you look at all liabilities, not just the mortgage and use a blended rate analysis to see if it would make sense to use home equity to consolidate other debts. This is a very tricky thing to work through, but with the right mortgage professional, they can make it very clear and easy to understand.

- Do I need to access my home equity for any reason? For example, home renovations, starting a business, improving your liquidity for rainy day funds, etc.

My recommendation for every homeowner, whether you have a mortgage or not or have the lowest interest imaginable, is to connect with a true mortgage professional, tell them about your real estate and financial situation and ask for their advice and guidance. If you have the right mortgage professional, they won’t sell you anything you don’t need and will give you a plan, strategy and timeline for whatever is in your best interest.

What should homeowners look for when comparing refinance offers?

My recommendation would be to search for the most educated mortgage professional that you can find. From there, they can help you in ways most mortgage companies don’t even consider. Unfortunately, most loan officers are not trained in personal finance or long-term real estate planning, so they are strictly looking to sell a loan. I’ve seen far too many people think that they got “the best deal, the lowest cost or the cheapest rate,” only to later find out that the strategy was wrong, and they ended up losing money or opportunity. If you’re strictly comparing price and cost, then understand that everything after that transaction will be on your shoulders. The alternative is to work with a proactive and committed mortgage team to ensure that your refinance is just one small part of a larger, long-term strategy and commitment. With the right mortgage lender, you should be excited about how they will help you in the future!

How can homeowners protect themselves from refinance scams?

Get referred to a lender by others. Check out their online reviews. Check to see how long that mortgage professional has been in the business by looking up their NMLS number. Go to their website and actually read what they are offering. What is important to that lender, and how are they committing to you long-term? If you read that one lender has “low rates” and another is committed to helping you achieve financial freedom, that should be a big clue as to whether you’re being sold or a valued client.