The Russian invasion of Ukraine has taken the world by storm. And while the United States has been mostly uninvolved in the conflict, US homebuyers are wondering how it will affect American markets, particularly the housing market.

Stock Market Volatility

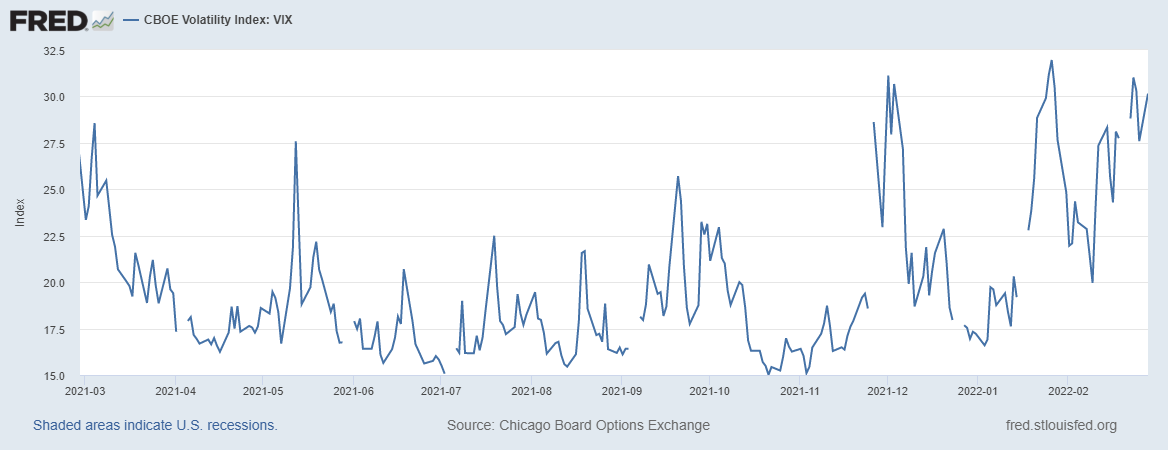

In all honesty, the only predictable component of war is unpredictability. There has been increased volatility across nearly every asset class across the world. Even those only indirectly related to the conflict, including the housing market, have already experienced a spike in volatility (see CBOE Volatility Index below).

The Volatility Index is an important index in the world of trading and investment because it provides a measure of market risk and investors’ sentiments. Many people become more cautious about their investments when global markets become unpredictable due to things like war or a pandemic. This has been seen in many conflicts before, such as the beginning of the Iraq War or the Gulf War. Usually, this volatility will subside before the conflict is fully resolved, but the rate at which these markets will return to normal will depend on the conflict itself.

When this particular conflict began escalating, many investors moved their assets into the bond market, which includes mortgage bonds, as they are generally considered safer investments. These bond prices rose as a result, and when bond prices go up, mortgage rates typically fall.

Even though there was a slight dip in mortgage interest rates at the beginning of the conflict, worries of a war in Europe is fueling uncertainty in the stock market which is helping to keep rates in check. This can be seen in Redfin’s most recent housing-market outlook, which remains relatively unchanged despite what is going on. They are still predicting slowing sales volume and price growth, as well as small rate increases throughout the year.

However, even though rates are anticipated to be generally unaffected, we may see some significant impact on the luxury real estate market. Wealthier buyers often cash out stocks or cryptocurrency to purchase expense homes or investment properties, and market uncertainty will likely make them hold off until returns increase. We could also see this uncertainty trickle down into conventional markets and buyers in all price ranges hesitant to pull the trigger on housing.

Supply Chain Challenges

Inflation and supply chain problems are expected to continue to lead to higher construction costs. Even before the conflict escalated, prices for building materials were already up 22% year over year. And according to the National Association of Homebuilders, lumber prices have nearly tripled in the last four months causing the price of an average new single-family home to increase by more than $18,600. Those costs will be passed along to new homebuyers.

“That’s a real problem for homebuilders. They can’t build to meet demand because they can’t get the building materials and appliances and the things they need to complete homes.”

Mark Zandi, Chief Economist, Moody’s Analytics

The fact that Russia—a longstanding rival of the US—is at the center of this conflict means that all markets across the world are likely to be affected. Russia is a key producer of oil, natural gas, minerals, and financial services. This means that energy prices are also likely to increase and that the global flow of capital will be suppressed.

Ultimately, the already accelerated rate of inflation is expected to rise even further. This will affect everyone: renters, buyers, and even builders who have already been stifled by rising construction costs.

What Does All This Mean For The Housing Market?

The Russia-Ukraine conflict will not stop US housing from increasing in value, although the gains might be a bit slower if demand decreases due to the uncertainty in the stock market.

Furthermore, the rate at which new homes are being built will likely slow down due to the fact that energy and building materials will be harder to come by. This means that building a new home will likely become a bit more expensive and the entire process will take a bit longer.

The good news is that if most buyers aren’t worried that they have to purchase a home now before mortgage rates go up any further, it could relieve some of the urgency and decrease demand, resulting in reduced competition.

The bottom line is that while it is important to be patient and watch how things play out, the Russia-Ukraine conflict should not make you afraid to move forward with your homebuying plans. If you have any questions about what to expect in the housing market as things unfold, reach out to your NEO mortgage advisor.