Over the last week, there has been an increase in the number of news articles and talking heads warning that major home price declines are on the horizon.

This negativity is largely in response to the release of Zillow’s September 2023 Market Report. The report shows that typical U.S. home values fell 0.1% from August to September – the first month-over-month decline since February.

Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize – and this happens every single year.

Here’s the context you need to really understand that trend.

What is Seasonality in the Housing Market?

Seasonality in real estate refers to the natural fluctuations in the real estate market that occur at different times of the year.

Every year, transactions and prices tend to be above-trend in the summer while activity typically slows down in the winter. Seasonality plays an important role in the housing market since it has an impact on supply and demand.

During winter and the holiday season in particular, demand tends to slow because people are unlikely to want to move. Aside from colder and more unpredictable weather, people are also dealing with end-of-year deadlines, family obligations, taking time off for the holidays, and more.

In the summer, on the other hand, real estate activity tends to increase. Families will often wait until the end of the school year when there’s more free time to move, so they don’t have to uproot their kids in the middle of the year.

The chart below from jpking.com shows Total Home Sales and Median Home Sale Price from June 2013 – June 2021, and it illustrates that this ebb and flow always plays out with remarkable consistency.

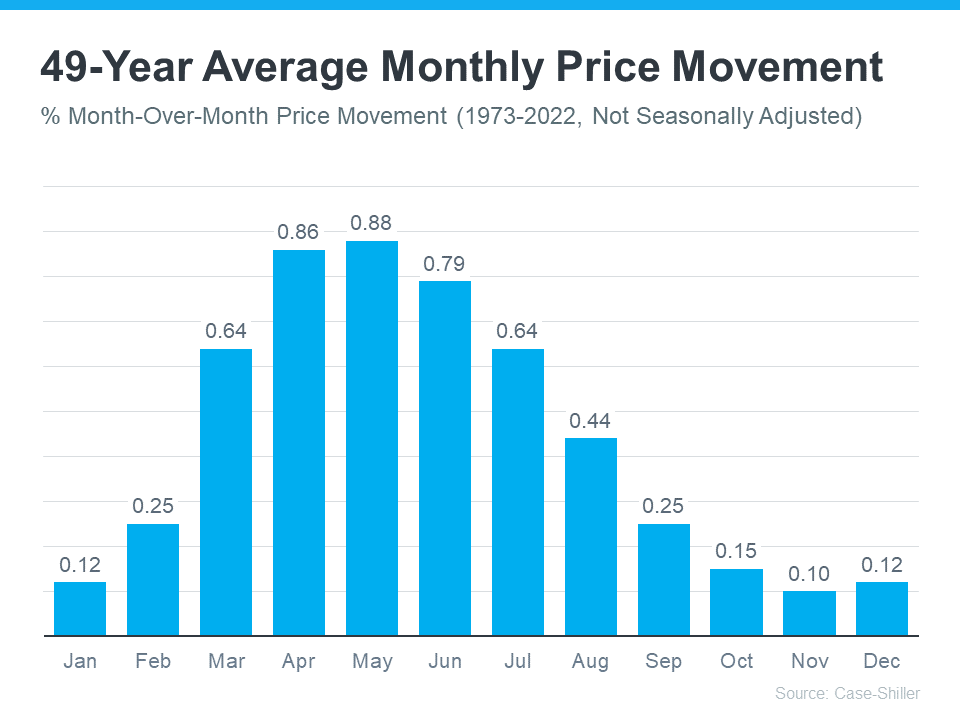

The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer markets. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality but muting homebuyer and seller activity. CoreLogic explains this in their September 2023 US Home Price Insights:

“High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

Even with the slowdown in the market, home values are still up considerably for the year. Depending on which report you look at, we are still on track to see between 5 and 8% cumulative appreciation for 2023.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

The Bottom Line

While the headlines are generating fear and confusion on what’s happening with home prices, the truth is simple. Home price appreciation is returning to normal seasonality.

What does this mean for you? If you can afford it, now is a great time to buy. The chances are very high that you will be able to get a great deal on a home and more favorable terms on your mortgage if you buy within the next few months. Once winter is over and we start to see some improvement in rates, competition will increase and prices will go up again.

Remember, wealth is not created by timing the market – it’s created by time IN the market. The sooner you buy a home, the sooner you will start building equity and be one step closer to financial freedom.